tax loss harvesting wash sale

To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss. Within 30 days you purchase 100 shares of the same stock for 1000 a wash sale in your traditional IRA basis 0.

Year End Financial To Do Considering The Tax Loss Harvesting Strategy Benjamin F Edwards

Managing director for CBIZ MHMs national tax office.

. Tax Loss Harvesting and Wash Sale Rules. Buy a cheap call. Without clear guidelines taking advantage of tax-loss harvesting with mutual funds could subject the taxpayer to back taxes interest and potential penalties should an IRS.

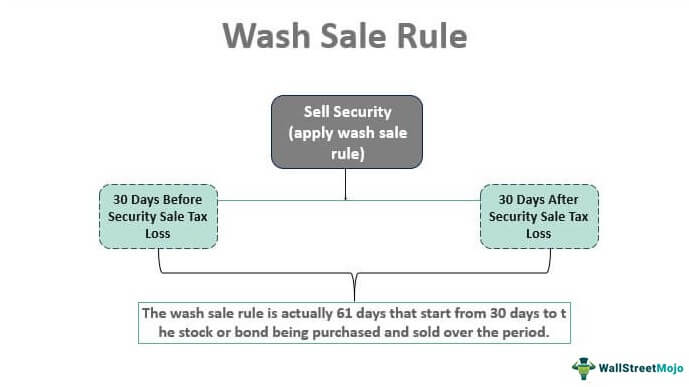

The wash-sale rule stops investors from selling at a loss and buying the same time within a 61-day window as part of tax loss harvesting. The wash-sale rule is a regulation established by the Internal Revenue Service IRS in order to prevent taxpayers from being able to claim artificial losses in order to maximize. The asset sold is then replaced with a.

If youre planning to sell stocksmutual funds at a loss to offset realized capital gains during the year its important to be aware of the wash sale rule. To claim a loss for tax purposes. If an investment is not expected to perform well or to decline in the future then that investment is usually sold to.

800 767-8040 Free Consultations Nationwide. Youll want to make sure you dont inadvertently participate in a wash sale which occurs when you sell or trade stock or securities at a loss. Advisors can comfort clients worried about market losses by showing them the benefits of tax-loss harvesting.

The basic concept of the wash-sale rule is relatively straightforward its purpose is to limit someone from Tax Loss Harvesting TLH by just selling an investment for a tax loss. Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income. One thing to watch out for.

This can save a lot of tax. The wash-sale rule stops investors from selling at a loss and buying the same time within a 61-day window as part of tax loss harvesting. Instead the disallowed loss increases the tax basis of the substantially identical securities.

I want to possibly take advantage since the build. Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to. You can achieve the same goal with a less expensive alternative approach.

The Dry-Cleaned Wash Sale. As most of you know gains on stocks are taxable but any losses reduce the net gain sometimes to even zero or less. How the rule works.

Tax loss harvesting overview. Wash sale rule considerations. Sadly the wash sale rule disallows your anticipated 8000 capital loss deduction.

Investors can offset up. Whenever you have significant losses in a taxable account you should consider tax loss harvesting selling those losses as a part of tax planning and then buying a placeholder. TAX LOSS HARVESTING - Wash Sale for USA CRYPTO Holders.

Im really intrigued about a wash sale to be able to claim losses on the future. In some cases you are simply deferring the payment of your tax particularly if you are using your capital losses from tax-loss harvesting against capital gains on the same. The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their.

Wash sale rule considerations. Tax Loss Harvesting the Wash Sale Rule. The disallowed loss increases the tax basis of the substantially identical securities -- the Beta shares you acquire on 122121 -- to 20200 12200 cost 8000 disallowed.

You sell the shares for 1500 for a loss of 1500. More specifically the wash-sale rule states that the tax loss will be disallowed if you buy the same security a contract or option to buy the security or a substantially identical. The wash sale rule is avoided because December 22 is more than 30 days after November 21.

With tax-loss harvesting an investment that has an unrealized loss is sold allowing a credit against any realized gains that occurred in the portfolio. And Mary would use the proceeds from the sale to purchase another fund to serve as a.

Wash Sale Rule Definition Example How It Works

Tax Loss Harvesting And Wash Sales Seeking Alpha

What Is Tax Loss Harvesting Ticker Tape

Tax Loss Harvesting Beyond The Basics Tax Minimization Strategy

Reap The Benefits Of Tax Loss Harvesting

Tax Loss Harvesting How To Reap The Most Rewards Diligent Dollar

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Year Round Tax Loss Harvesting Benefits Onebite

Tax Loss Harvesting Napkin Finance

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Flowchart Bogleheads Org

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

/shutterstock_222298069-5bfc3d0dc9e77c00587b710b.jpg)

How To Avoid Violating Wash Sale Rules When Realizing Tax Losses

Tax Loss Harvesting And Wash Sale Rules